Upside Down Car Loan

- August 12, 2020

- Posted by: alakra

- Category: Finance & Accounting

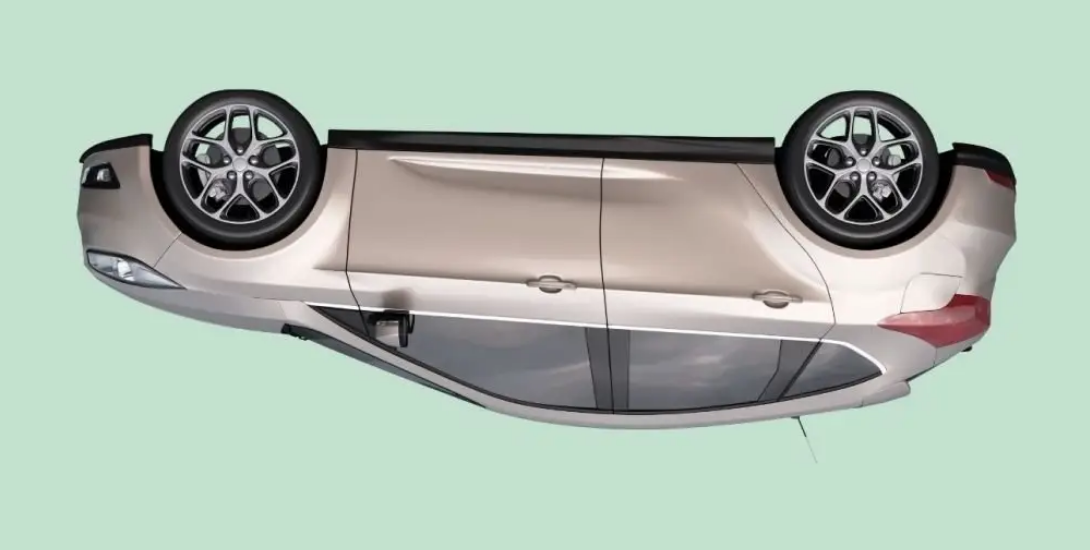

The recent economic upheaval left many Canadian with large amounts of debt and other financial problems. One such problem is the upside-down car loan. You have likely heard about the many houses that homeowners have walked away from once they owed more than the home’s value.

Similarly, car owners are finding themselves perplexed when the amount they owe on a car surpasses it’s current value. Are you in this position? How does an upside-down car loan happen?

An upside-down car loan, also known as a negative equity car loan, is a loan where you owe more for your car than it is worth. You can get yourself into such a situation in a number of ways:

One of the most common problems when buyers with credit less than perfect are looking for a vehicle that suits their lifestyle and to keep for a long time, and the

dealer wants to sell them a vehicle that is going to make them the most profit, not a vehicle that’s going to suit the customer’s needs. They try to put you in a different vehicle that suits them and tell you to just drive it for few months to build better credit and come back and trade it in, at a very high-interest rate and all the profit they made, not to forget the add-ons the pushed into your payments. So now, your vehicle is worth half of what you paid for and you haven’t left the dealership.